Every child should have what they need to grow, live, and thrive with dignity—and financial security is one key way to get there.

Unfortunately, Latino children are far more likely to be born into families with limited or no wealth, drastically hindering their future economic opportunities. Furthermore, because wealth is largely passed on from one generation to the next, when children start out on an uneven economic playing field, the next generation of their families are much more likely to live in poverty.

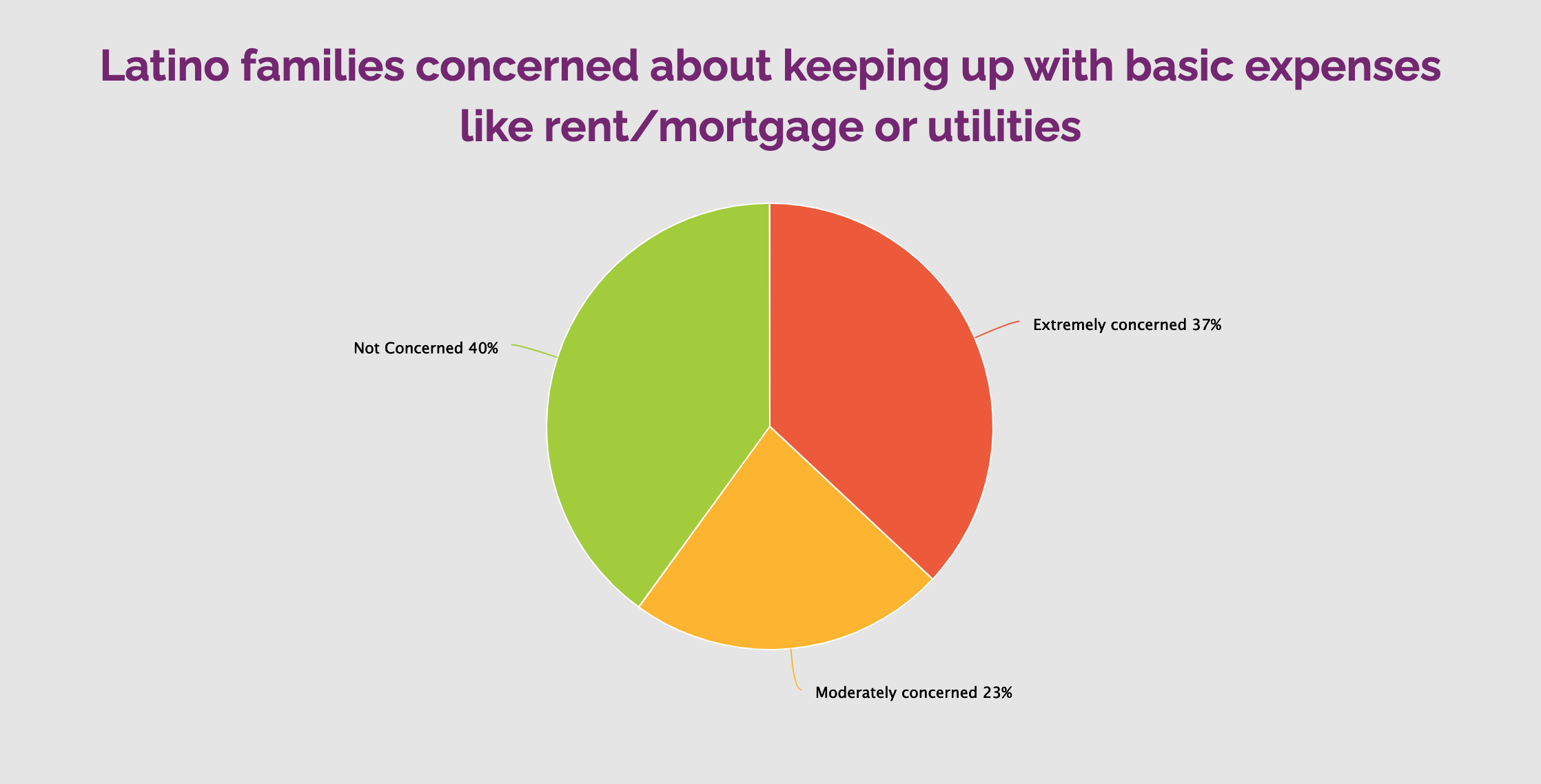

In a recent survey of Latino families commissioned by Abriendo Puertas/Opening Doors and UnidosUS, 60% of respondents stated that they would not be able to provide a good future for their children. Additionally, 59% of respondents said that they would not be able to afford to pay for their children’s childcare or educational expenses. And worryingly, 60% responded that they would not be able to keep up with basic expenses like rent/mortgage or utilities.

This next generation of Latino children are highly unlikely to be able to build generational wealth without systemic policy shifts at the state and federal levels that support these opportunities for our children.

Providing public funds and leveraging these with private sector investments is one solution being discussed nationally that can help build intergenerational wealth for today’s children. These investment accounts—known as “baby bonds” in some circles—were originally conceptualized by economist Darrick Hamilton.

Baby bonds are significant monetary investments made by governments on behalf of children to be used for future wealth-building. They are designed to narrow the racial wealth divide by providing the largest investments to children from the lowest-income households, which are disproportionately households of color.

Here’s how baby bonds work:

- A substantial monetary contribution is invested by a government on children’s behalf; children from households with the lowest amount of wealth or income receive the largest investments.

- Funds are held by the government and invested on behalf of children, and they appreciate over time until they are sufficient for a significant asset purchase in adulthood.

- Young adults use the funds toward acquiring assets that grow appreciably and generate wealth (e.g., homeownership, postsecondary education, small business start-ups).

Research has found that baby bonds have the potential to significantly narrow the racial wealth divide. If a national baby bonds program had been started in the mid-1990s—benefiting people who were 18-25 years old in 2015—among participating households, instead of white households having 15.9 times the wealth of Black households, they would have had only 1.4 times the wealth of Black households, dramatically narrowing the wealth gap between children.

While a national program is the ultimate goal, to ensure the critical scale and impact on the racial wealth divide, states are taking meaningful steps to provide children with the financial resources they need to start building wealth.

In 2021, Connecticut and Washington D.C. passed legislation creating the first baby bonds programs in the U.S., and momentum is only growing with legislation proposed in at least 9 other states.

With increased awareness and opportunity, partners at the local level are building grassroots movements of families who are saying they want these types of public and private sector innovative solutions to tackle historically unsolvable problems like intergenerational poverty.

In the previously mentioned national survey of Latino families, 81% of parents and caregivers support the government establishing savings accounts for children to later use in early adulthood for retirement, college or help purchase a home.

Through innovative policies supported by families such as baby bonds, states have the opportunity to make a historic investment into their state’s children, closing the racial wealth divide, and building a bright economic future.

For more information on solutions proposed by Latino families, visit the full report here: National Latino Families Survey 2023